Funded Futures Trader 30s Timeframe Scalper 30s Model Guide Author Options Degenerate

Always learning, trying to improve every day, hoping to "pay it forward" the knowledge

that has been shared with me.

Follow me (@outof0ptions) on X for the 30s

model trades, analysis and guide updates as well as TradingView Indicators.

Feel free to buy me a ☕ to

support and encourage my work

In the latter part of 2021, I made a decision to take a more proactive role in managing my

finances, I blame covid boredom. I invested in growth stocks such as Amazon

(AMZN) and Tesla (TSLA).

My timing was fortunate, coinciding with a period of strong upward momentum 🚀 in the stock

market. Due to personal circumstances, I withdrew most of my investments

towards the end of 2021, which, in hindsight, was a stroke of luck as the market soon

experienced a significant downturn. I was incredibly lucky to not only make a good

return on my investments but

also to keep it, a rarity for a novice trader.

This experience got me excited, and I continued to trade sparingly over the next few months. My focus was primarily on gambling the tech companies’ earnings, relying on what I thought to be my industry knowledge, oddly enough🤷 I continued to achieve moderately positive results.

In early 2022, a health scare 😷 landed me in the hospital for nearly a week. With time on my hands and work no longer occupying my thoughts, I stumbled upon the infamous Reddit sub, WallStreetBets. Initially, I used it as a source of entertainment, but it introduced me to options trading. While options seemed risky at first, I learned about covered-calls, which appeared to be a safe way to supplement my “buy & hold” investments.

I made small profits from selling covered-calls that expired out of the money after 1–2 weeks. However, my early successes and greed led me to experiment with a riskier strategy known as vertical-spread. My approach involved buying far out-of-money spreads 3–4 weeks in advance, hoping the price wouldn’t reach the strike price, allowing me to keep the premium difference. When this strategy looked like it would fail, I would roll the spread into the future, which usually worked out a few weeks later. To streamline this process, I leveraged my programming skills to develop a tool using MBOUM API that identified out-of-money options spreads with the largest price difference between adjacent strikes for the stocks I was monitoring.

This was great for a while, as it didn't require too much leverage, however, I was spending a ton in commissions, leaving me with only couple a hundred bucks in-profit per-trade that on average lasted 1–2 weeks. My "strategy" was based on selling call spread after post-earnings bump expecting prices to re-trace a bit, which most of the time did happen.

However, my successes bred overconfidence, and I decided to take on higher risk. I rationalized that selling naked puts as relatively safe as long as I chose a sufficiently out-of-the-money strike and a far enough date. The worst-case scenario would be to either roll them forward or own a stock at a deep discount. This seemed reasonable, especially for what I considered “cannot fail” stocks. I started selling puts 6–12 months out (leaps), using my modified tool to hunt out options with a decent amount of premium where I could reasonably expect to capitalize on at least $3–5 worth of premium without having to wait for the option’s expiry.

Until that point, I had been managing things on my own, which was mostly profitable, but I craved more. I realized that I had reached the limits of my self-taught knowledge and needed assistance. While browsing WallStreetBets, I noticed a user who posted daily analysis on SPY and shared some of his options trades based on this analysis. He also had a paid Discord channel where he promised to teach his strategy in real-time. The fee was under $30 per month, so I decided to give it a try in the hopes of expanding my knowledge.

The good news is that I discovered TradingView, which has become my go-to charting tool. I also learned about indicators like EMAs, SMAs, VWAP, RSI, and many others. These indicators, when used correctly, supposedly lead to winning plays 🤣. However, for some reason finding winning combinations was only possible in hindsight, and in real-time, the win rate was at best 50%.

The mentor I was following primarily traded 0DTE SPY options, aiming for a 10% gain with a 20% stop-loss. Despite the negative risk-reward ratio, this strategy seemed to work for him. However, following his trades was nearly impossible due to the high volatility. His strategy was primarily based on EMA/RSI and required a significant amount of screen time. The few trades I made following him were mostly losses. However, the community was beneficial, and I learned about futures from one of the traders there.

I continued to pay the monthly fee, hoping to glean some valuable knowledge, while continuing my own "strategy" of selling naked puts. The group helped me refine my narrative and make better decisions based on the feedback of the more successful traders. One of the members correctly predicted the imminent failure of some banks, which prompted me to hedge my bets.

Unfortunately, my learning was limited, and I found myself constantly flipping between different indicators in search of the “one”. I even upgraded to the highest tier subscription on TradingView to have more than 20 active indicators at any given time 🤯.

As the saying goes, “all good things must come to an end,” and indeed it did in March 2023,

when Silicon Valley Bank (SVB) was closed down, followed by

Signature Bank (SBNY) a few days later. I was left holding naked sold puts on

these ‘fail-proof’ stocks. The catastrophic failure was slightly cushioned by the

fact that I heeded the advice of a trader on Discord and hedged my position by buying some

puts and selling some calls just a day before. Despite this, my losses were

substantial,

wiping out all my gains thus far and then-some.

SBNY was closed over the weekend, after being largely halted for trading on Friday. The news left me devastated and completely shattered. My girlfriend was with me that weekend, and despite her best efforts to console me, the magnitude of the disaster was overwhelming. My strategy and mindset were completely destroyed that week. Sleep eluded me for the next few days as I replayed the what-if scenarios and tried to understand how a strategy that had worked for so long could fail so spectacularly.

I couldn’t bring myself to open the broker for the next few days and only resumed trading a week later because I got margin called and had to close a few more positions, further adding to my already big losses.

To add to the turmoil, the start-up I was working at full-time was on the brink of collapse. While I had anticipated it, the news a month later that my tenure was ending was unwelcome. The company itself shut down a few months later. Truly, when it rains, it pours…

It took me some time to honestly reflect on my situation, primarily because it was difficult to acknowledge that my approach was flawed. However, I was determined not to give up. My persistence, perhaps to a fault, wouldn’t allow me to admit defeat.

The first step I took was to cancel my Discord subscription. I wasn’t learning there, and it felt like most of us were just part of a retail mob, gambling on price movements without any real strategy. Somehow, I stumbled upon ICT, who was just beginning his 2023 free online mentorship on YouTube and Twitter.

ICT’s approach, which focused on predicting rather than reacting, was a revelation. It gave me hope and inspiration. I began watching his videos from the 2022 mentorship (also free), along with his earlier videos. I would watch 3–5 videos per day, trying to absorb as much knowledge as quickly as possible. However, this proved to be an impractical approach. I was retaining very little and getting confused between Fair-Value-Gaps, Order Blocks, Breaker Blocks, and a host of other concepts. But his concepts and live tweets, predicting market movements ahead of time, gave me hope and inspiration.

I naively thought that I would master the Fair Value Gap concept in a month, maximum two and have the market at my fingertips. Fortunately, I refrained from attempting to trade ICT concepts live and instead tried to demo trade on TradingView using the built-in Paper-trading platform. As expected, my failures far outnumbered my successes. I realized I needed help.

While I didn’t find much useful ICT-related content on Reddit, Twitter was a treasure trove of ICT disciples sharing their knowledge. I added dozens of them to my feed, hoping to glean insights that would help me master ICT trading strategies. Looking back, I can’t help but laugh at my naive belief that consuming information in the form of videos, commentary, and tweets would make me a successful trader.

I did come across a few excellent traders, such as Kplus, Hydra, Opsec, SirPickle whose insights I still value. They were, and still are, publishing lots of free educational ICT content on X and YouTube. But I felt I needed more personalized guidance to make significant progress quickly, I was rushing to undo my losses.

Kplus tweeted that he was starting a small-group mentorship program. Although it was a bit pricey, I saw it as an investment in my learning process. So, I signed up for what ended up being a three-month program where we would analyze price action in real-time with our mentor a few times a week and watch selected ICT videos on various key topics on our own at other times.

Paying a significant amount for the program made me take my learning more seriously. I started taking detailed notes in Notion on every video I watched and every group session we had. I also spent 6–8 hours per trading day watching price action on my own, trying to apply what I was learning to real-time price action. I refrained from live trading and mostly focused on watching and trying to predict the market. Although I was mostly wrong, I was convinced that it would eventually “click”.

About a month into the mentorship, I discovered Dodgy on Twitter. He was prolific on Twitter and YouTube, offering tons of free educational content. I started following him and joined his Discord where he educated and called out plays. Since Dodgy was streaming and commenting daily, along with the occasional 🚦, it seemed like a great way to get more guidance during my "off-time" from Kplus' mentorship. After a 7-day free trial, I paid for a month of his paid mentorship tier, which also offered a monthly 1:1 session. This was around mid-April 2023.

Around the same time, after roughly 140 hours of screen time, I felt ready to take on the market. I had developed a “strategy” of taking 5 points on ES (S&P 500 Futures) from an FVG, as ICT suggested, and all I needed was an FVG for entry. I was confident that the market makers wouldn’t see me coming! When Apex had their 90% off sale, I seized the opportunity and grabbed two accounts. I believed that with Dodgy’s occasional signals and what I had learned, success was guaranteed. However, my accounts lasted only about two days before I made every textbook mistake possible: over-trading, over-leveraging, revenge trading, and so on.

Despite this setback, my overconfidence persisted. I paused trading for two days, reloaded a few more accounts at 80%, and tried again. Somehow, in the beginning of May, I managed to pass two evaluations and got my first funded accounts after trading the minimum required time of 7 days, adding approximately $500 to the balance each day. This was a significant confidence boost and seemed to validate everything I was doing. In reality, a few of my wins were the result of simply following Dodgy’s signals or lucky plays based on taking the first 1m FVG during the AM Silver Bullet (10–11am EST) or PM Silver Bullet (2-3pm EST) time windows.

The euphoria was short-lived. The first funded account blew up the very next day, and the second one didn’t last much longer, taking about four days to blow up. This was somewhat painful, as getting a funded account cost $160, significantly more than the $19 or $38 evaluations.

To borrow Dodgy’s catchphrase, “not gonna lie,” this cycle repeated a few more times during the months of May, June, and July. I would get Apex accounts on the cheap (80/90% off), blow most of them, pass a few, and then blow those up as well. Each time, I felt that my knowledge was growing and that it was just a matter of time before I succeeded, but each time, I ended up failing. During that four-month period, I blew dozens of evaluations and probably 8–9 funded accounts. Fortunately, I was doing okay with my options trading, which covered the losses I was taking from blowing up accounts. At least, that was how I rationalized my “process.”

Simultaneously, I was still studying, filling Notion with copious notes, and so on. My charts became largely free of indicators, but they were now filled with dozens of FVGs in every direction along with every possible swing high/low from higher-time-frame (HTF) down to 1m. Needless to say, it was very confusing. I could understand how ICT, with his 30 years of experience, could work with naked charts (just price action, no doodles), but how my mentors could keep their charts clean with 1–3 FVGs and maybe 1–2 lines showing draw-on-liquidity (DOL) after only doing ICT for a few years was beyond my comprehension at that point. I was convinced that there had to be some sort of trick, some formula, or an ICT indicator that would make all the difference.

By July 2023, my initial mentorship was drawing to a close. I had secured a lifetime membership with Dodgy back in May for $350, which, in hindsight, was probably the best investment I made during my entire learning journey. Unfortunately, I was no closer to receiving a payout from a funded account. Despite being able to pass an evaluation 30–40% of the time, I couldn’t keep a funded account alive for more than a week, no matter what I did. I would incur a loss, attempt to recover it, become frustrated, and end up depleting the account.

One particular instance stands out. On a Friday uptrend day, I entered a short position around 3 pm, near what I thought was the peak. I figured there was no way we could continue to rise; we were already up over 300 points on NQ, a reversal had to be imminent. I kept adding 1 NQ every 10 points, thinking a reversal was just around the corner. However, seven minis in, I was hoping for a break even. The market makers had other plans, and the market continued to rally until about 3:55 pm. At that point, my account was blown, just before a small retracement of about 20 points before the close.

A few months earlier, based on Dodgy’s suggestion during one of our 1:1s, I had switched from S&P 500 (ES) to Nasdaq (NQ). The volatility on Nasdaq made it much easier to get 12.5 points (equivalent to 5 ES points) and typically didn’t require as long of a hold.

As my first mentorship was coming to an end and I was struggling to find consistency, I began to question things. Aside from a few funded certificates, I had little to show for my efforts. At this point, I had probably watched over 100 hours of videos, spent over 50 hours in live sessions with mentors, and dedicated over 400 hours to my own screen time. I was growing desperate and starting to realize that my initial estimate of mastering ICT concepts in 1–2 months may have been a bit optimistic. I attempted to pass one more evaluation using only the signals that Ryan (Dodgy) would occasionally drop on streams. As you can imagine, I failed. My entries were never as good, I was chasing because I was too scared to enter during the initial “signal”, then ended up entering late (chasing) due to FOMO and using far too much leverage. What happened then is that a draw-down of even a few points would scare me out of trades (3 points on NQ with 5 minis is $300) and then close at BE due to fear of losing a play, missing out on winners and only ending up with the losing plays.

To give you an idea of some plays I took (please learn from my mistakes), Ryan would say these equal or relative-equal highs should hit (and he was right 90% of the time) when we were a few points away, so I would enter with 3–4 minis thinking this is guaranteed and the price would reverse and drop 15–20 points effectively taking me out before going to target. These chases seem to always work out for other people, at least what I could see in discord comments and Ryan himself, but for me, they were like a 3rd rail of trading I would get fried nearly every chase.

Something had to change. By mid-August, I largely stopped getting evaluations (about 3 between Aug – Oct, all blown), focused on Ryan’s videos & live streams, and continued to revisit ICT’s older content along with the new stuff he was putting out in 2023. I actually stopped taking as many notes as I did before, and focused all my efforts on trying to understand the Inversion FVG strategy Ryan was teaching. I could see him winning using this strategy every time he would come on stream and while I could understand the logic & mechanics of it, I for the life of me couldn’t do it still. 4–5 months into the mentorship, I was still struggling. My inherent stubbornness was pretty much the only thing keeping me going, perhaps a dash of refusal to admit defeat.

Around this time, I came to a realization: having too much information was just as detrimental as not having enough. The wealth of knowledge I had accumulated led me to question every move and doubt every potential entry, as I could always find a reason why each setup might fail. For instance, this FVG seemed risky because of that Order block, that inversion seemed risky because there was another FVG above or below, and so on.

I also began to understand that I was often my own worst enemy when it came to trading. My personality traits made it challenging for me to hold onto long-term trades, especially when they fluctuated from green to red, only to return to green and hit the final take-profit target. I realized that I wasn’t a day trader who could hold positions through significant up/down swings or aim for 40–100 point plays like some traders I followed on Twitter or in Dodgy’s discord. Even though I could handle it when it came to options, when it came to trading futures, I was a scalper at heart. I needed to enter the market, make my profits quickly, or accept my losses and move on to the next trade.

I attempted to implement Ryan’s Inversion model in this manner. While Ryan was producing a ton of quality content, which I would watch without fail in real-time, I had to admit that I couldn’t execute it on my own. At this point, I knew that relying on signals was a path to failure and certainly not a sustainable long-term strategy. That being said, I was still absorbing knowledge, sometimes subconsciously, and it wasn’t just from Ryan. There were other brilliant traders on his discord, like Leppyrd, Levi, and Mythy, who were generously sharing their knowledge.

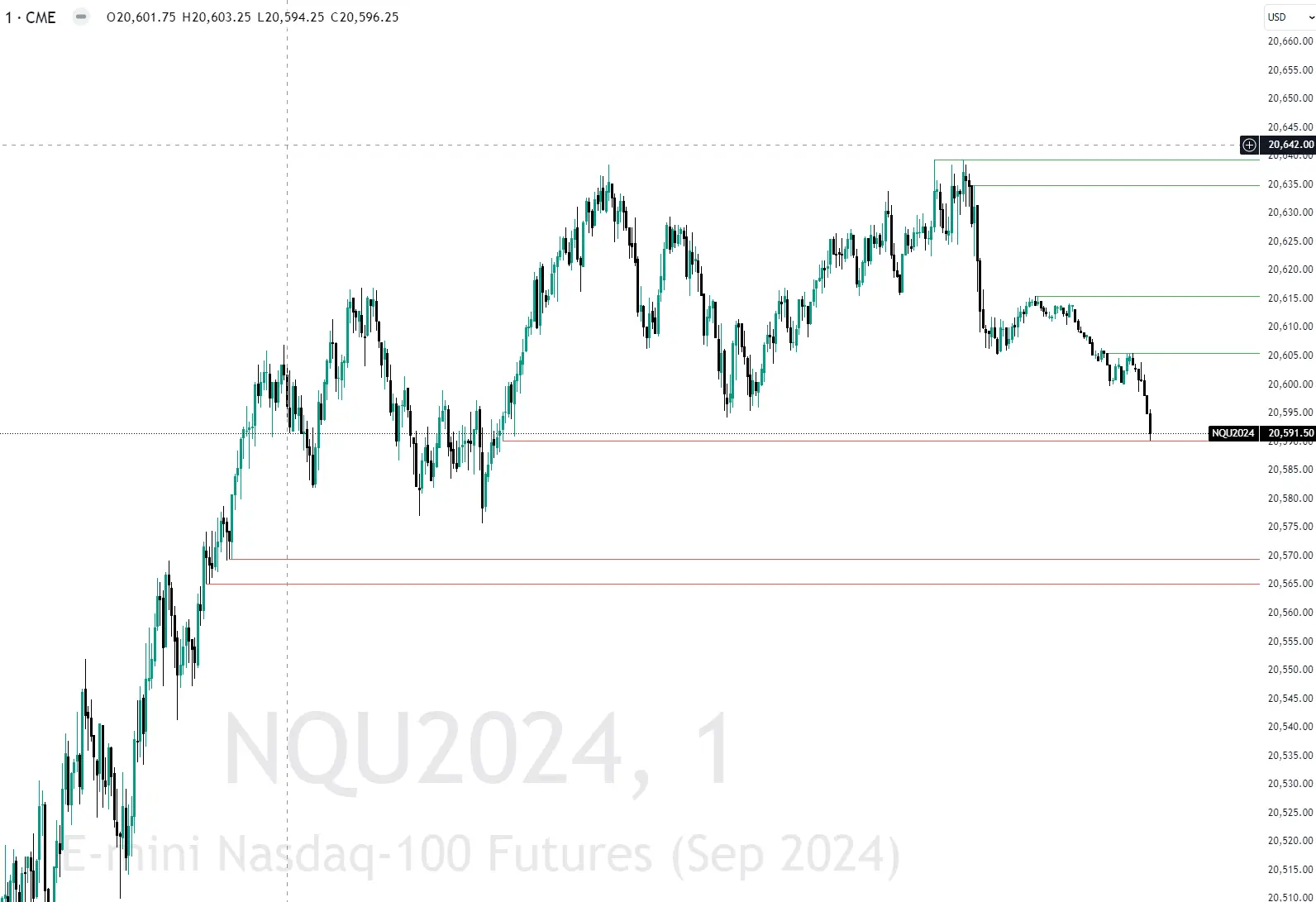

I stopped consuming more new content from ICT, realizing that less was more. I needed to master a basic model, not add even more confusion with new knowledge. However, in early October 2023, ICT did one of his weekend spaces where he briefly talked about a trading model he created for his son Cameron. I didn’t listen to the space itself, but someone on discord provided a summary of the model. At a high level, it involved a scalping strategy that took a 30s FVG formed after a 5/15 swing high was taken, aiming to get 10pt of profit with a 12 stop-loss. This seemed a bit odd to me because of the negative risk-reward ratio, but the model supposedly had a massively high win rate, and ICT had the receipts to prove it. His son even made it onto the TopStep leaderboard with 14 consecutive winning days.

At first, it was an intriguing curiosity, and I filed it under something to look into later. A little while later, Leppyrd, one of the experts in Ryan’s discord, shared his back-testing results on the model. He significantly simplified the approach, allowing 1m swings to be used, etc. Along with the back-testing, he also made a video to help explain the model, which from then on was dubbed the “Leppyrd model”. This piqued my curiosity, and I watched the video a few times, bombarding Leppyrd with questions on discord. There was something there.

Around this time, Ryan was rarely streaming PM sessions. He would usually stream the morning session, call out a few bangers, and the lunch (12–1:30 pm) / PM (2 pm–4 pm) session was unaided and often chaotic when it came to price action. One of the guys who I hadn’t noticed in discord before, Plyo, came to stream a few PM sessions and talked about order blocks. I had been interested in Order Blocks since my start with ICT. In fact, Hydra, another ICT alumni, with his strategy based around morning macros and order blocks, had made me genuinely curious about them. However, I confused myself between the different types of OBs (Breakers, Rejection, Reclaimed, etc.) and couldn’t get it to work.

Plyo’s straightforward explanation and strategy of using bearish order blocks at their extremes for entries resonated with me. It was a simple yet effective way to use them on an extremely low time-frame (30 seconds). This, coupled with Leppyrd’s ongoing advocacy of the Leppyrd model that operated on a similar time-frame, intrigued me.

I decided to test it out. I conducted a quick back-tests, but I have a personal aversion to back-testing. The ability to press a button and see the outcome, without experiencing the challenge of enduring real draw-down or counting candles while the price fluctuates around a few points away from the take-profit, felt inauthentic. So, I opted for forward testing the model, initially on a demo, then after a few days, using an eval account. As I was doing this, I observed the price action, trying to address the issue that had been bothering me from the start—the negative risk-to-reward ratio of the model. Some might call me arrogant, a trading novice trying to improve on a model developed by the master himself (ICT) and further refined by an expert trader (Leppyrd), but it was a challenge I was determined to take on.

This led to the creation of the “30s Model Guide”. I must admit, it took about two weeks of focusing almost exclusively on this model and three blown evaluations, but it worked. At first, it was tentative. I was often scared to enter trades, and for full disclosure, until this moment, I had never looked at a 30-second time-frame, let alone traded it. But it was working. I was battling my own scar tissue from the previous eight months of trying to trade ICT Concepts, but I was executing my own trades, based on my own bias and technical analysis. Yes, I was taking some losses, and I was closing winning trades for break-even or even taking a small loss because my interpretation of the price action suggested that the trade could fail, but I was doing it.

I started to track my trades, something I had tried before but could never stick to for more than a few days. It feels like an achievement, akin to an AA milestone. I have journaled for the 30s model for 28 30 continuous trading days. To hold myself accountable, I share all trades in a public Google doc, including wins, losses, and trades I skip for whatever reason. I also created an X account to showcase the logic behind each trade I actually take, serving as a sort of public journal.

Perhaps it was serendipity, the alignment of the stars, or the culmination of 1,000+ hours of screen time, hundreds of hours of streams, mentorship, refusal to admit defeat, or a combination of all these factors. But the confluence of ICT introducing the 30s model, Leppyrd simplifying it, and Plyo finally helping me grasp order blocks was the triumvirate that led to my breakthrough.

Interestingly, in his 2023 mentorship, ICT predicted that people who stick with it would start seeing results in November. Sometimes it feels like the guy could predict the future. I finally understood why screen time was so important, and why Ryan kept emphasizing it on stream. I won’t lie, there were times earlier in my journey when I wanted to throttle him every time he mentioned it.

Approximately eight months have passed since I embarked on my journey with ICT. ICT conducted his last stream (X Space) on November 11, 2023. If he remains true to his word, this could signal the end of new ICT content. However, he has undoubtedly left a trail for others to follow, not to mention a thriving community of traders who utilize, refine, and educate others on his concepts. These remarkable individuals generously share their hard-earned knowledge without expecting anything in return, teaching me invaluable lessons along the way. Inspired by their generosity, I aspire to “pay it forward” by sharing my journey and persistently refining the 30s Model Guide.

Special Thanks To:

All the knowledge around ICT Concepts Helping me grasp ICT concepts, gain screen-time and understand the value of it Simplifying "Cameron Model" into "Leppyrd Model" and proving it out through

backtesting Inspiring me about Order Blocks (Breaker Blocks) & Macro Times Helping me grasp Order Blocks Helping me on my journey of understanding draws on liquidity

As to where to go next, have a few goals in mind:

- Pass my

current evals

- Nov 13, 2023 - 4 Apex and 1 TakeProfitTrader left, 3 Bulenox, 1 Topstep, 11 Apex done)

- Nov 14, 2023 - 1 TakeProfitTrader left, 3 Bulenox, 1 Topstep, 15 Apex done)

- Nov 15, 2023 - 3 Bulenox, 1 Topstep, 15 Apex done 1 TakeProfitTrader

- Dec 29, 2023 - 3 Bulenox, 2 Topstep, 17 Apex, 1 TakeProfitTrader, 2 MyFundedFutures

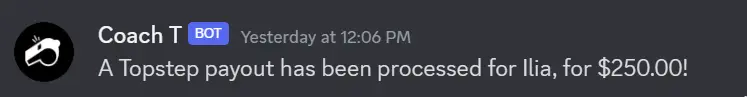

- Get a

TopStep Payout

- Recover 2 old Apex Fundeds from deep draw-down - Nov 15, 2023—blew up not trading the model

- Master Inversion Model (6-month goal)

- Master DTFX Model (Giving myself 8-12 months)

- Get 1st Payout on Apex/Bulenox/TakeProfitTrader/MyFundedFutures

- Get my fundeds past trailing draw-down

- Accumulate sufficient payouts to trade my own funds (long-term goal, 2025?)

- Continue to refine 30 Model (this is a journey, no end...)

If I could go back, here’s what I’d tell my beginner self about trading.

-

Study ICT ConceptsDon't waste time with retail strategies, indicators, etc... Learn to anticipate and predict market moves, not react to them after the fact.

-

Give Yourself TimeMarkets are hard, success requires not only studying, but also A LOT of screen-time, don't expect results until at least 8–12 months

-

Find a Model That Works for YOUDon't jump between different trading strategies (ICT has many), find the one that matches your personality. Even the best model will fail you if it doesn't match your personality.

-

Validate Model & Psychology with Eval AccountDemo is great for finding a model, but to truly confirm it need to trade it with real money, the cheapest/safest way to do it is with cheap (<$20) Eval accounts. You won't know your comfort level and psychology until you have to hold "real money" through draw-down or have a green trade go to red in your chosen model.

-

Learn to Take LossesEven your winning model will lose, take the loss, don't try to average-out or move stop-loss, wait for next setup to make money back.

-

Don't Over-leverageBuild confidence with small sized positions (2–3 micros, then 3–4 micros, then 1 mini) don't jump in with large positions. Draw-down on large sizes can take out before hitting take-profit or scare you out of a winning trade.

-

Trust YourselfOnce you have YOUR MODEL that you feel confident in, trust it, don't let external noise get in a way.

-

Go SlowDon't base your expectations on the results of expert traders with lots of experience and screen-time, trying to match their results and leverage will only bring on losses, slowly build trust in your own model with small gains and eventually start to size-up.

| Prop Firms | Details | Promos |

|---|---|---|

| Tradeify | Reliable Prop Firm

|

30% off for existing users, 50% for new people |

| Bulenox | Even cheaper than Apex, but their website is not great and support is limited, they do offer

end-of-day draw-down accounts

|

83% off (trailing draw-down) - Cheapest eval at the

moment |

| Elite Trader Funding | Probably best for more experienced/established traders

|

85% discount lifetime discount excludes fast tracks Promo Code: OUTOFOPTIONS |

| Other Stuff | Details | Promos |

|---|---|---|

| Dodgy's Discord | Really helpful discord, daily live trading and commentary, tons of educational content, occasional signals! | |

| TradingView | My go-to charting and trading tool I use with a few prop-firms (TopStep, TPT, etc...) when I don't copy trade | Currently running 70% off Black Friday sale |

| Replikanto | This is the TradeNinja copier I use, works well even across different Prop Forms | 40% off with BLACKFRIDAY40 code |

| TraderSync | The software I use to track P&L and performance of my options trades | Currently running 65% off Black Friday sale |

| ForexFactory | Free news calendar for all market-moving news, they color code news by their likely impact on the market | |

| NordPass | My preferred password manager, cheap, works on all platforms, keeps track of data breaches that may affect you | Currently, 58% Off, using YJ6BYS code will give you an extra 3 months for free |

| NordVPN | I use this whenever I am traveling on my computer and phone to encrypt my connection. Sometimes even at home when trading servers in my area are glitching | Currently, 69% Off, using my referral link will give you an extra 3 months for free |

Model Results Source Document

https://docs.google.com/spreadsheets/d/1GDH3y89uDM2FqiueO_JWVo6f_vi4iK8bWSx45AOqiIc/edit?usp=sharing

Equal Highs and Lows

This indicator is designed to create a visual representation of the equal highs and lows formed and automatically removed mitigated ones in real-time.

How It Works:

The indicator scrutinizes each price bar within the chart’s present timeframe, limited to

the

user-defined max bars look-back for optimal performance. It captures and visually depicts

each

occurrence of equal prices with a horizontal line on the chart, connecting two points of

equal

price. A unique feature of this tool is its ability to remove the line once the price

mitigates

the

equal high/low by falling below the equal lows or rising above equal highs. This ensures the

chart

remains uncluttered and highlights only the currently relevant levels, setting it apart from

other

indicators designed to identify equal highs/lows.

Configurability:

The indicator offers five style settings for complete customization of the lines that

represent

equal highs/lows. These settings include line style, color, and width, along with an option

to

extend the lines to the right of the chart for enhanced visibility of equal high/low levels.

To

optimize performance, the indicator allows users to configure the look-back length,

determining

how

far back the price history should be examined. In most instances, the default setting of 500

bars

proves more than adequate.

Relative Equal Highs and Lows

This indicator is designed to create a visual representation of the relative equal highs and lows formed and automatically removed mitigated ones. Unlike indicators designed to show exact equal high/ lows, this indicator allows a small, configurable degree of variance between price to identify areas where price stops.

How It Works:

The indicator tracks all unmitigated highs & lows within the chart’s present timeframe,

limited to the user-defined max bars look-back for optimal performance. If the prices are

within the configured variance they are marked as relatively equal and at that point are

visually identified by a horizontal line, which connects the two (or more) points of price.

Depending on configuration of the indicator, a line is rendered from the 1st, last or both

values within the relatively equal range of price. A unique feature of this indicator is its

ability to remove the line once the price mitigates the relative equal high/low by falling

below the lows or rising above highs. This ensures the chart remains uncluttered and

highlights only the currently relevant levels, setting it apart from other indicators

providing similar functionality.

Configurability:

The indicator offers five style settings for complete customization of the lines that

represent equal highs/lows. These settings include line style, color, and width, along with

an option to extend the lines to the right of the chart for enhanced visibility of equal

high/low levels. To optimize performance, the indicator allows users to configure the

look-back length, determining how far back the price history should be examined. In most

instances, the default setting of 500 bars proves more than adequate. Additionally, you can

set thresholds via separate configs for stocks & indices that will determine if the price is

relatively equal and lastly allow you to configure where the indicator line should be drawn,

the first, last or all the values.

Notes:

This uses a different approach then my “equal highs/lows” indicator to identify price levels

and because it focuses specifically on relative as opposed to exact values it is entirely

different and may show “weaker”, but still important levels of liquidity. This indicator is

more suited for analysis of stocks and indices or higher-timeframes where price-action

rarely forms exact equal values instead more frequently forming almost equal values. My

other indicator is more suited for smaller (15m or less) timeframe on indices where exact

equal prices are often identical. Depending on situation different indicators should be

used.

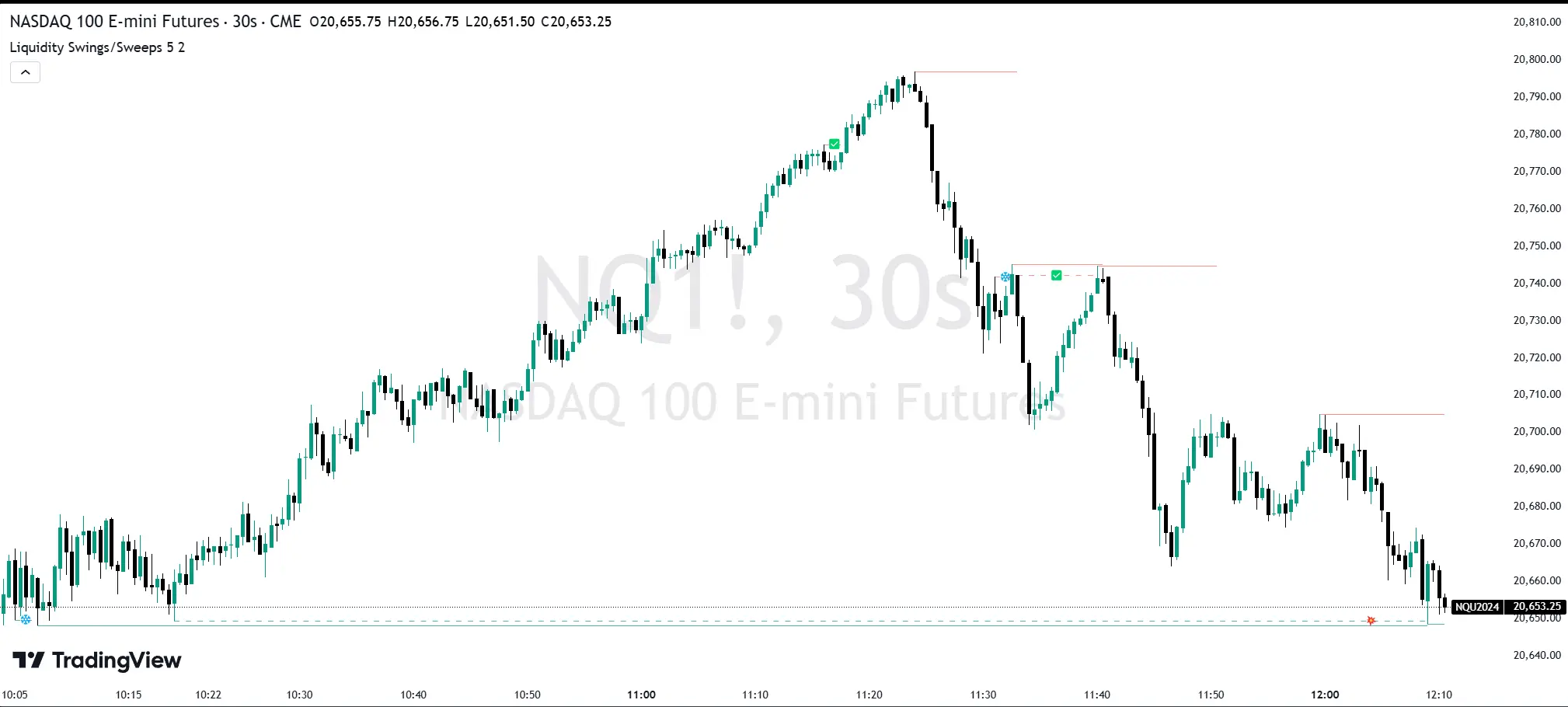

Liquidity Swings & Sweeps

This indicator is designed to create a visual representation of liquidity as identified by swing Highs/Lows along with an indication of the liquidity level that was swept, optionally rating the strength of the sweep based on time and price.

Video Guide: https://youtu.be/O1o4Z4cv-wg

How It Works:

The indicator tracks all swing points, as identified using user-defined strength of the

swing. Once a swing is formed that meets the criteria, it is represented by a horizontal

line starting at the price of the current swing until the last bar on the chart. While the

swing is valid, this line will continue to be extended until the swing is invalid or a new

swing is formed. Upon identifying a new swing, the indicator then scans the earlier swings

in the same direction looking for a point of the greatest liquidity that was taken by the

current swing. This level is then denoted by dashed horizontal line, connecting earlier

swing point to the current. At the same time any liquidity zones between the two swings are

automatically removed from the chart if they had previously been rendered on the chart. If

the setting to enable scan for maximum liquidity is enabled, then while looking back, the

indicator will look for lowest low or highest high that was taken by the current swing

point, which may not be a swing itself, however, is lowest/highest price point taken

(mitigated) by the current swing, which in many cases will be better price then the one

represented by previous swing. If the option to render sweep label is enabled, the sweep

line will also be completed by a label, that will score the sweep and a tooltip showing the

details of the level swept and the time it took to sweep it. The score explained further in

configurability section ranks the strength of the sweep based on time and is complemented by

price (difference in price between the two liquidity levels).

Configurability:

A user may configure the strength of the swing using both left/right strength (number of

bars) and optionally instruct the indicator to seek the lowest/highest price point, which may

not be the previous swing that was taken out by a newly formed swing.

From appearance perspective liquidity level colors and line width presenting the

liquidity/swing can be configured. There is also an option to render the liquidity sweep

label that will generate an icon-based rating of the liquidity sweep and a tooltip that

provides details on the scope of the swing, which includes liquidity level swept and when it

was formed along with the time it took to sweep the liquidity.

Rating is of sweeps is primarily based on time with a secondary reference to price

- 💥- Best rating, very strong sweep with an hourly or better liquidity sweep

- 🔥- Second rating, strong sweep with 15 – 59 minute liquidity sweep, or 5+ minute sweep of 10+ points

- ✅- Third rating, ok sweep with 5–15 minute liquidity sweep, or lower-time-frame sweep of 10+ points

- ❄️—Weakest sweep, with liquidity of 5 or fewer minutes swept

Volume Gaps and Imbalances

This indicator is to visually depict price inefficiencies, as identified by Volume Imbalances (VI) or Gaps. A Volume Gap is a scenario where the wicks of two successive candles don’t intersect, while an Imbalance occurs when only the wicks overlap, leaving the bodies apart. These zones of inefficiency frequently act as magnets for price, with the market striving to rebalance in accordance with ICT principles.

How It Works:

The indicator keeps track of all Gaps/Imbalances from the beginning of the available history. It automatically removes all mitigated Gaps/Imbalances, which are situations where the price has at least reached the bottom of a bullish gap or the top of a bearish gap. On the last bar, the most recent valid gaps are highlighted with a box drawn from the start to the end of the gap. The start of a bullish gap is determined by the highest price of the previous candle’s open or close, while for bearish gaps, it’s the lowest price of the previous candle’s open or close. Conversely, the end of a bullish gap is the lowest price of the current candle’s open or close, and for bearish gaps, it’s the highest price of the current candle’s open or close.

To enhance the indicator’s speed and minimize chart noise, only the most recent gaps will be displayed, up to the limit set in the indicator settings.

Each displayed VI/GAP will indicate the size of the imbalance in ticks. For imbalances greater than 3 ticks, which represent stronger draws of liquidity, the color transparency will be reduced, and the text will be made more prominent. Volume Gaps are also marked with a 🧲 emoji for easy visual identification.

The indicator will automatically extend the boxes representing valid imbalances to the current bar for as long as the imbalance is not mitigated. If an imbalance has been tapped but not mitigated, the indicator will append 🚩emoji to denote that the imbalance has been partially mitigated and may no longer have as strong of a draw for price.

Configurability:

You can configure the number of imbalances to show, the setting applies to bullish/bearish

imbalances individually. This setting can be set to any value from 1 to 50.

Appearance wise, color, style and color transparency of each box representing an imbalance

can be configured. The imbalance box label can be configured by setting the text size, along

with the vertical and horizontal alignment.

Flat Tops/Bottoms aka Devil's Mark

This indicator is designed to visually depict price inefficiencies, as identified by Flat Top/Bottom Candles (aka Devil's Mark). A Flat Top/Bottom Candle is a scenario where there is an absence of a wick at the top or the bottom of the candle. These represent zones of inefficiency and will frequently act as magnets for price that the market will strive to rebalance in accordance with ICT principles.

How It Works:

The indicator keeps track of all Flat Top/Bottom Candles from the beginning of the available history. It automatically removes all mitigated Flat Top/Bottom Candles, which are situations where the price has gone past the candle without a wick.

Configurability:

You can configure the colors, style & width of the lines used to represent flat top/bottom

candles.

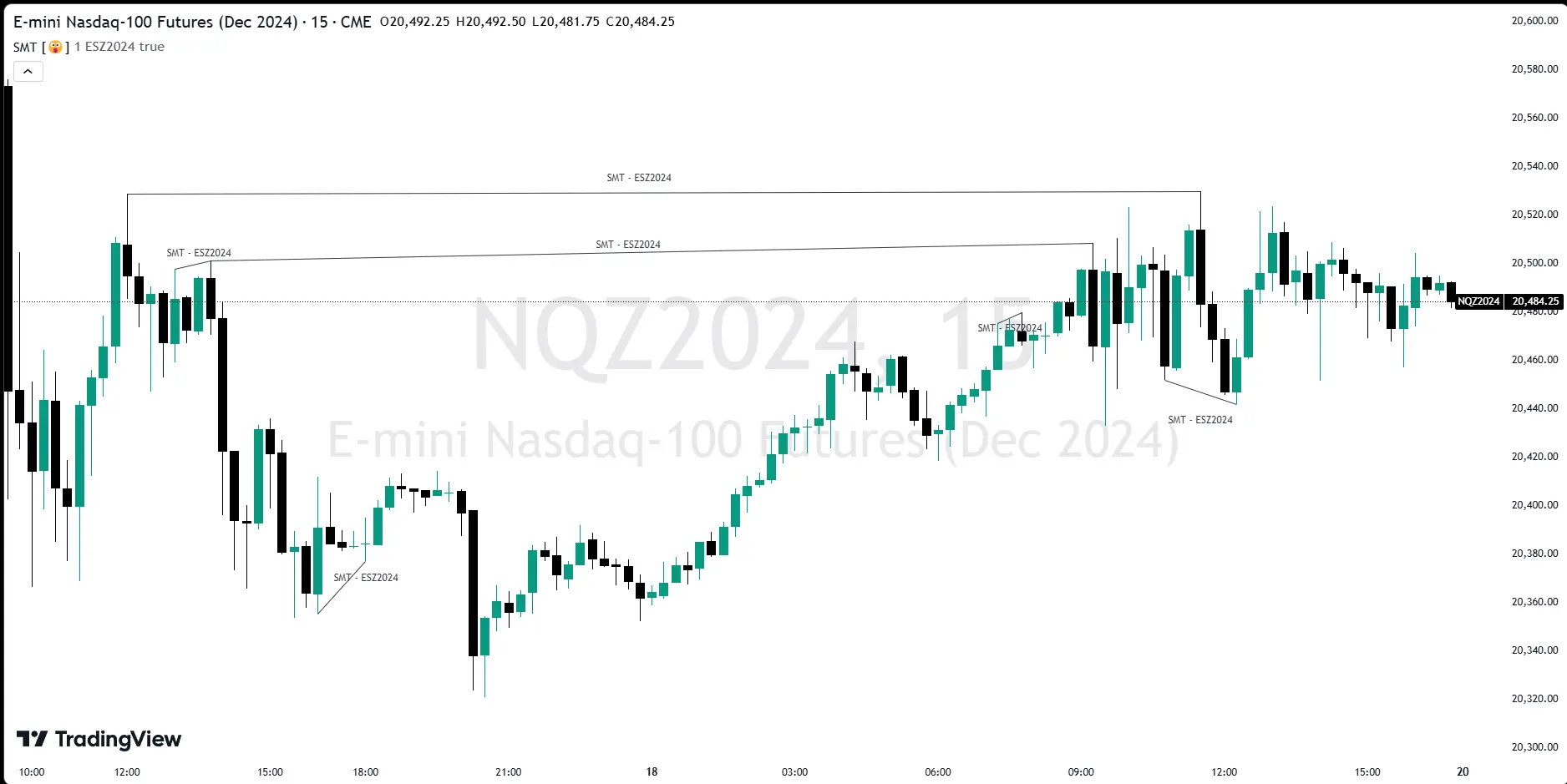

SMT Divergences

Smart Money Technique (SMT) Divergence is designed to identify discrepancies between correlated assets within the same timeframe. It occurs when two related assets exhibit opposing signals, such as one forming a higher low while the other forms a lower low. This technique is particularly useful for anticipating market shifts or reversals before they become clear through other Premium Discount (PD) Arrays.

How It Works:

This indicator works by identifying the highs and lows that have formed for an asset on the current chart and the correlated symbol defined in the settings. Once a pivot on either asset is formed, it checks if the pivot has taken liquidity as identified by the previous pivot in the same direction (i.e., a new high taking out a previous high). If this is the case and the corresponding asset has not taken a similar pivot, the condition is determined to be a potential valid divergence. The indicator will then filter out SMTs formed by adjacent candles, requiring at least one candle difference between the candles forming the SMT.

If the “Candle Direction Validation” setting is enabled, the indicator will further check both assets to ensure that for bullish SMTs, the last high on both assets was formed by down candle, and for bearish SMTs, the low was formed by an up candle. This check can often eliminate low-probability SMTs that are frequently broken.

Configurability:

- Pivot strength—Indicates how many bars to the left/right of a high for pivot to be considered, recommended to keep at 1 for maximum detection speed

- Candle Direction Validation—Additional SMT validation to filter out weak/low-probability SMTs be examining candle direction

- Line Styling for Bullish/Bearish SMTs—Ability to customize line style, color and width for bullish/bearish SMTs

- Label Control—Whether to show SMT label and if shown what font size and color should be used

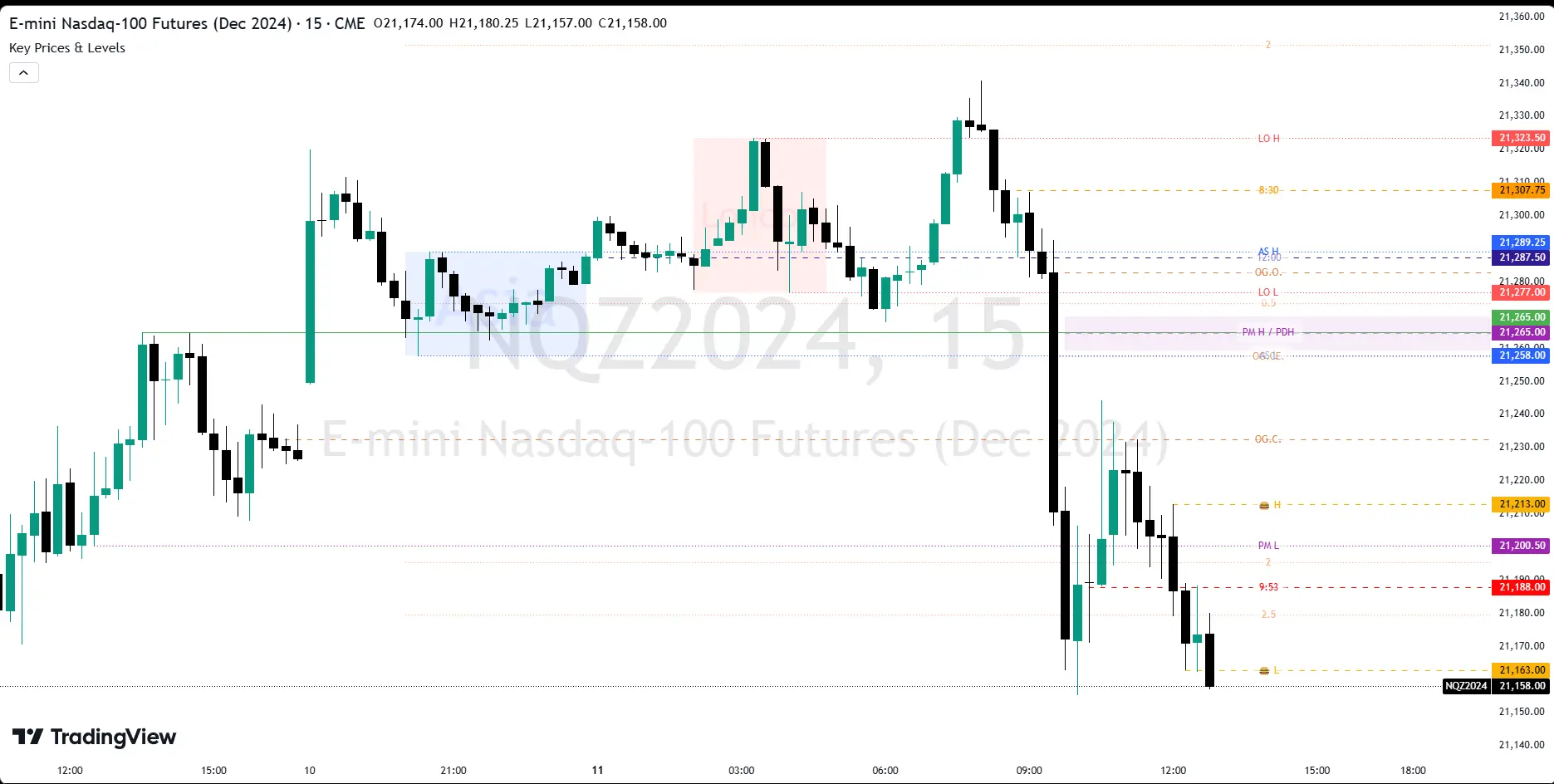

Key Prices & Levels

This indicator is designed to visualize key price levels and areas for

NY trading sessions based on the price action from the previous day, pre-market activity and key

areas from the NY session itself. The purpose is to unify all key levels into a single

indicator, while allowing a user to control which levels they want to visualize and how.

The reasoning and how each price level can be used is explained in this video

https://youtu.be/PWxgek_uhP4?si=zQ-exGCejr8cB5Da

The indicator identifies the following:

- Asia Range High/Lows, along with ability to visualize with a box

- London Range High/Lows, along with ability to visualize with a box

- Previous Day PM Session High/Lows

- Current Day Lunch Session High/Lows, starts appearing after 12pm EST once the lunch session starts

- New York Open (8:30am EST) price

- 9:53 Open (root candle) price

- New York Midnight (12:00am EST) price

- Previous Day High/Lows

- First 1m FVG after NY Session Start (after 9:30am), with the ability to configure minimum FVG size.

- Opening Range Gap, showing regular market hours close price (previous day 16:15pm EST close), new session open price (9:30am EST open) and optionally the mid-point between the two

- Asia Range 50% along with 2, 2.5, 4 and 4.5 deviations of the Asia range in both directions

Configurability:

- Each price level can be turned off

- Styles in terms of line type, color

- Ability to turn on/off labels for price levels and highlighting of prices on price scale

- Ability to control label text for price levels