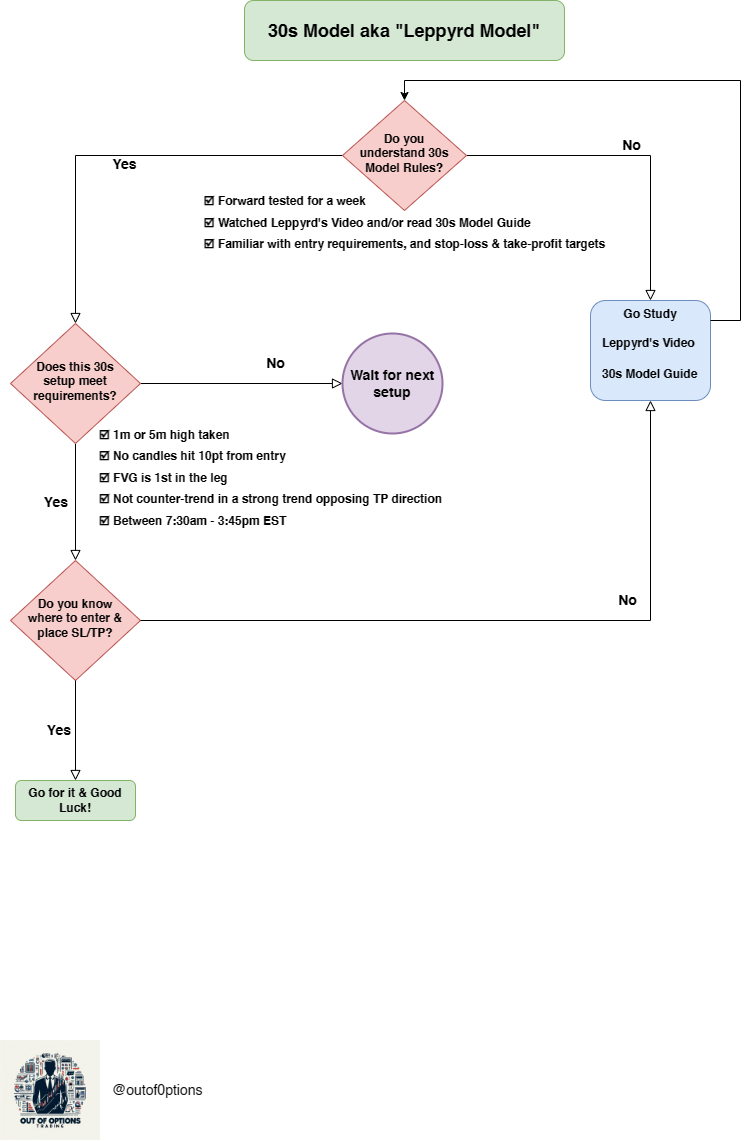

30s Model

DISCLAIMER: This is my personal model’s description and findings. I’m not a financial advisor, and this isn’t financial advice.

The 30s model is a NASDAQ (NQ) scalping strategy that is based on entries inside 30-second fair-value gaps (FVG), which are created following liquidity being taken on a higher time-frame. My tests indicate a success rate exceeding 70% for the model.

If you have questions about this model you can reach me on Twitter @outof0ptions or in Doddgy’s Discord

Acknowledgments

The model was originally developed by Inner Circle Trader, who designed the “Cam” model for his son. A comprehensive explanation of the original model can be found through Ryan aka DodgyDD, who has been instrumental in my understanding and application of ICT concepts. The model was further streamlined and back-tested by Leppyrd. Detailed insights into the “Leppyrd” model can be found here. I would also like to acknowledge Plyo for enhancing my comprehension of order blocks.

Building upon the foundations laid by these folks, I am incorporating my own modifications and rules into the model, a process that will continue as I progress.

Base Knowledge

It’s important to mention that if you’re not yet acquainted with ICT’s teachings, I would advise starting with a fundamental understanding of his concepts, which are available on his free YouTube channel. If the content there seems perplexing, Dodgys’s Discord comes highly recommended. There, he provides real-time daily instruction and trading using the ICT model. Without this foundational knowledge, the concepts discussed here may be difficult to apply.

Entry Rules

- At a minimum, a 1m high should be taken, 3m or 5m high would provide greater confirmation. (The success rate of 1m/3m/5m is about the same in my experience)

- A 30s FVG must be formed (It doesn’t matter how big the FVG is, even 1 tick FVGs work)

- If any candle, including 3rd candle that forms the FVG goes more than 10 points from the FVG before providing an entry inside the FVG, DO NOT ENTER, setup is no longer valid. (Success rate of those setups drops dramatically)

- The FVG must be 1st in the leg, if it is 2nd or greater, DO NOT ENTER, setup is no longer valid.

- Is the market is a strong trend, in an opposite direction from the FVG, DO NOT ENTER, the setup has a low probability of success. (Counter-trend setups in a strong trend will frequently fail)

- Check the time, if it is before 7:30am EST or after 3:45pm EST, DO NOT ENTER. (My experience with the model is between those times, it may behave differently outside of these hours)

If all these rules are adhered to, you’ve back-tested this model on your own and are confident in the results, you can enter the setup with 10 point take-profit (TP) and 12 point stop-loss (SL).

Managing the Trade

- Do not adjust SL, price will often go to near take-profit and then revert to entry or even a few points below to eventually hit TP.

- If the original FVG is inversed and a new FVG in an opposite direction is formed, it is a good sign the model will fail. Try to exit for BE or reverse position targeting SL as the new TP. (Still testing, but reversal with original SL at TP seems to work well as a way of making some money back or ending the trade in the green)

- If the price is chopping for more than 5 minutes without delivering to target, it is a likely sign the model could fail. In my experience, price usually delivers within 4.5 minutes, when in counter-trend setups delivery should be in 2-3 minutes. After 5 minutes, it is likely price will go to SL, with one-exception being when going with a trend before market open (6am - 8:30am EST)

- Do not take partials, this model has good success rate, but it does fail 30% of the time, partials will mess-up your overall R:R, since losses will deliver full loss and partials will eat up a portion of your potential profits.

Closing for Breakeven or Reversing?

In general, the safest option for a failing 30s play is to close it for BE or close to BE if the opportunity presents itself.

Reversing should only be done if:

- The original play was counter-trend

- There is an obvious DOL in the other direction, towards which the price is moving without any PD arrays (FVGs, BPRs) in the way

- Ideally a 30s FVG was formed to the otherwise creating an inverse 30s play

- The original 30s play already took some meaningful liquidity, without hitting take-profit

- Price has momentum to the opposite direction

Here is an example of a play where closing for BE (break even) would make more sense than to inverse. The EQL (equal-lows) provided a reason for price to wick down, which required inversion to form before rapidly reversing and moving to take-profit of the 30s long.

This example meets the criteria for reversing the play. The initial long position was counter-trend, we took internal liquidity and reversed down with momentum, inversing entry FVG and forming a new FVG to the downside, with internal liquidity targets available without any PD arrays in the way.

Advanced Entry Strategies

Usually, the price partially enters the FVG. Adjusting your entry from the most aggressive point can boost your R:R, though it may result in missing some setups. In these scenarios, while the TP stays unchanged, the SL should be minimized to align with the base setup’s SL.

- Enter at the Consequent Encroachment (CE aka mid-point) of the FVG, simplest & most mechanical way. Keep in mind this is 30s FVG so 4th candle maybe the only one offering entry, you’ll need be real quick at figuring out the mid-point.

- Enter at OB rejection inside the FVG, using candle wick as an entry point. Not every setup will have this and you need to have a solid understanding of order blocks. This has best results in terms of maximizing profits and delivering to TP target.

- Enter at the bottom of the FVG, simple & mechanical. However you will miss many setups, certainly setups where the FVG is larger than 4 pts in size, price will rarely go to the bottom of the FVG.

Tips & Words of Caution

- Nothing in the markets is guaranteed, this model does fail. I’ve seen many instances where it delivers to within 1 tick of take profit just to reverse and hit stop loss.

- This is not a good model for full port, the model fails 30% of the time and you don’t want to blow your account and lose money because you happen to pick the one setup that fails. The model works on repetition and statistics being in your favor. Simple math is that for 10 setups taken, you are likely to win 7 (

7*10=70points of profit) and lose 3 (3*12=36points of loss), netting you 34 points of profit, with 1 mini that is still $680 in profit.

- This model works best with minis, it does still work with micros, but slight differences between the indexes (NQ vs MNQ) may in some cases result in no-fills or phantom setups.

- Ideally the take profit is in a direction of some meaningful DOL (equal highs/lows, un-tapped FVG, etc..) and doesn’t require the price to reach or exceed that point to hit your TP. There should be a reason you can see why the price would go to TP. If TP happens to rest inside a random point inside an FVG, or form a new high/low, this may not be a high-probability trade.

- The model works best in chop conditions, when in a trend it is best to only take the model in the direction of the trend, which happens rarely.

- Avoid entering trades immediately after the NY open (15-20 minutes) and 1-2 hours after major news events such as FOMC, NFP, and CPI. During these times, price movements can be volatile and can easily trigger stop-loss orders before reaching the take-profit level. It is best to wait for the price to stabilize and establish a clear direction before entering a trade.

- Before the close of 4-hour candles (10am & 2pm EST), the price may be very volatile and unpredictable. The model may fail unless there is a strong confluence for the price to move towards the take-profit, such as higher timeframe equal-highs/lows in near proximity of TP, market structure confirmation (DOL), or a strong trend in the trade direction.

- If the price is consolidating within a narrow range of 25-30 points, measure the range and only take trades in the direction where the majority of bodies are located. This is likely the draw. If you are in a trade in the opposite direction, look to exit at 50% of the range. (See https://x.com/outof0ptions/status/1722358336912269792?s=20 for details)

The Good

- Model presents itself multiple times per day, over 10 times on average in a trading day. Great for psychology and avoiding FOMO because there is always next setup available.

- It is quick to deliver, no long waits for it to play out, great for psychology on longer plays where you wonder if you should take early TP or be upset when green play goes into red. It also allows you to minimize chart time because of its speed.

- It is simple, and beginner (such as myself friendly), you need to understand just a few basic ICT concepts such as FVGs, Order Blocks and basic draw on liquidity.

- Doesn't require you to know or have a daily bias.

The Bad

- Can cause FOMO, as it often can run for dozens of points past your TP.

- Even though model's success rate is 70%+ it can fail multiple times in a row, and on occasion have days where number of losing plays outnumber the winning ones.

- As much as it seems like one, this is not a mechanical model, in trend conditions or when there is a strong DOL in opposing direction model often fails.

Examples

Wins

Losses

F.A.Q

Q: Can this be used with other indexes and/or crypto?

A: My experience is only with NASDAQ (NQ), I have not seen any data showing similar behaviors in other indexes.

General Links & References

(Links with ** beside them use my referral code)

Education

- ICT’s Youtube Channel - The original source of reference material on all things ICT from the Michael Huddlestone (ICT)

- Dodgy Youtube Channel - Lots of simplified video, market reviews etc… on ICT concepts

- There is also a free discord and a paid one ** (I bought it) and it has been a huge help.

- Leppyrd’s Twitter - Daily market reviews

Prop Firms

- Bulenox ** - Arguably the cheapest prop-form you can get, but you get what you pay for… currently has 90% off sale (I’ve passed their evals using 30s model)

- Apex ** - 2nd cheapest prop firms, often runs 80/90% off sales. (I’ve passed their evals using 30s model)

- EliteTraderFunding ** - Not the cheapest, but has a really nice UI and good rules to stop you from blowing accounts.

- TakeProfitTrader ** - Very similar to ETF above, with one difference of being able to request a payout after 1 day of getting PRO account.

30s Model Stats

My stats for using the 30s model, entries in bold are plays I took personally.

https://docs.google.com/spreadsheets/d/1GDH3y89uDM2FqiueO_JWVo6f_vi4iK8bWSx45AOqiIc/edit?usp=sharing

30s Printable Cheat-Sheet